By Lea Efird

Traditional structures of nonprofits are the realities for most of these entities, but hybrid and for-profit structures are on the rise in the US and internationally and have also been successful. If a nonprofit reevaluated its accomplishments, goals, etc., would the 501(c)(3) model be most effective for it, versus new legal/financial possibilities?

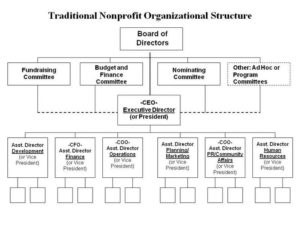

Traditional Nonprofit Structure, Pros and Cons:

PROS:

- The traditional 501(c)(3) model is time-tested and widely accepted by US society and government

- It offers tax exempt donations

- It is often required for grants from certain organizations, especially governmental grants

- The board and structure allows a variety of rotating opinions to be present in nonprofit leadership, as well as allows it to network with the community through its selection of board members

CONS:

- The tax code for a traditional nonprofit is complicated and requires huge amounts of documentation

- Board members are usually rotating often, meaning that consistency in leadership can be lacking and there are distractions like looking for new members, etc.

- The board hires and fires the executive director/other top execs, meaning that if the current executive director decides to find a new job, the process to hire a new person would be long and create a gap in programming

- Not being well-equipped to turn a profit means that there is reliance – perhaps over-reliance – on grants and donations

- Current/future board members are not necessarily experts in what each nonprofit desires to accomplish (ex – not professional artists or art historians, folklorists, historians, etc.), leading to more explanation to them about reasoning behind projects rather than more immediate understanding of the process

- It limits partnerships with for profit corporations because of goal differences, meaning that other nonprofits are almost solely the community partners with whom strong relationships exist

Alternatives to the traditional nonprofit corporation:

Other avenues are being tried by various for-profit/non-profit/socially conscious entities, including blended models that are successful in many instances.

From the Stanford Social Innovation Review:

“The business model would use product sales to fund its social mission, reducing dependence on donations, grants, and subsidies, as well as to scale up the organization. Rather than take a nonprofit model and add a commercial revenue stream—or take a for-profit model and add a charity or service program—Hot Bread Kitchen’s integrated hybrid model produces both social value and commercial revenue through a single, unified strategy” (Battilana, “In Search of the Hybrid Ideal” [link below]).

“Hot Bread Kitchen exemplifies a larger trend among social innovators toward creating hybrid organizations that primarily pursue a social mission but rely significantly on commercial revenue to sustain operations. Such hybrids have long existed in certain sectors, such as job training, health care, and microcredit—but in recent years they have begun to appear in new sectors, including environmental services, consulting, retail, consumer products, catering, and information technology” (ibid.).

From Harbor Compliance, a nonprofit that helps establish other nonprofits:

B-corporation

“A benefit corporation (B-Corporation) is a new type of corporation. It is a for-profit corporation that meets rigorous standards of social and environmental performance, accountability, and transparency. B-Corps are appropriate for organizations that attract significant investment and reward investors. However, they must at the same time give directors additional license to make decisions in line with not-for-profit goals as opposed to shareholder profits. B-Corps often obtain third-party certification, such as “B Corp” certification from B Lab.”

*examples in NC are Piedmont Biofuels, Rain Water Solutions, and Larry’s Coffee

Click here to search B-Corporations in general.

Social Purpose Corporation (SPC)

“A social purpose corporation or an SPC is a type of for-profit entity in some U.S. states that enables corporations to consider social or environmental issues in decision making instead of relying only on profit-maximizing goals. The Social Purpose Corporation structure permits consideration of these issues but does not require it.”

*legal in Washington, Florida, and California

* Cited source

Nonprofit LLC

“LLCs are a less formal structure to administer than a corporation. Only a few states offer nonprofit LLCs. Some states have a minimum number of directors required to form a nonprofit corporation and a nonprofit LLC can provide a loophole to form a smaller nonprofit. For example, in Missouri a nonprofit corporation requires three directors but you can form a nonprofit LLC with only one member.”

*not currently available in NC

L3C

“Low-profit limited liability companies (L3Cs) are for-profit social enterprise ventures. This structure was created to help bridge the gap between for-profit and non-profit investing by mirroring federal tax standards for program-related investing (PRI). It preserves the tax flexibility of a traditional LLC.”

*NC has dropped this form, the only state to do so currently after adopting it in 2010

Source for other types of corporations.

See also: For-Profit Companies with Strict Standards of Social/Environmental Consciousness

Potential Pros and Cons for picking a different structure than a 501(c)(3):

PROS:

- Significant revenue stream reduces reliance on grants and donations, meaning more potential funding, less time spent applying and reporting on grants, as well as fewer restrictions on projects that could be completed

- The lack of a required board or change in the level of power of the board vs. employees of the organization mean fewer hoops to jump through, meetings to plan, etc.

- More fluid relationships with other organizations and businesses in the community

- Employment of professionals in various capacities will be easier and finding replacements will be faster, meaning that long-term goals of the organization will be easier to maintain across employee changes

CONS:

- Donations are not necessarily tax deductible

- Other nonprofits, donors, etc. would potentially be less comfortable or familiar with a hybrid model

- Potential for significant revenue does not guarantee the revenue will exist, meaning grants will still be needed – and many grants require 501(c)(3) status

- If already established as a traditional nonprofit, the structure change will require legal, social, and board-related appeals and potentially months of work

- Staying true to the missions of social service and not drifting into creating revenue against the public good is an ethical problem of these entities

Broader questions for consideration:

- What are the revenue streams that would allow a hybrid model to exist? Are they adequate to significantly reduce needs for grants and donations?

- What structure would be best for each individual nonprofit? Consider goals, time and money restraints, purposes in larger community, and roles in target communities vs. the public eye.

- If already established and a hybrid structure is picked and more thoroughly researched, would the Board of Directors authorize such a change?

- Would the change be practical, given the legal, financial, and social changes it would require? If so, at what time would the process start?

- Would there be a continuation of the Board, an Exec Director, etc.? If not, what employees would be needed?

- What goals and by-laws would be instituted by this new version of the nonprofit? If the same by-laws will be used, only tweaked, will that work with the new structure?

- How will the organization produce deliverables that demonstrate their social consciousness, vs. the revenue that they take in because of their sales, etc.?

Before establishing or changing the structure of a nonprofit, make sure to consider carefully the pros, cons, and potential problems that traditional or modern structures would pose for each specific organization. The individuality of each organization means that there is no one solution for all socially conscious organizations; however, more legal variety can greatly expand the possibilities for organizations looking to make a positive difference in the world.

……………………………………………………………………………..

Le a Efird, our 2015 APPLES summer intern and a student at UNC Chapel Hill, Class of 2017, is a double major in Spanish and History, minoring in English. She currently resides in Chapel Hill, but is from Albemarle, NC. Her future plans include earning a Master’s of Social Work and a PhD in History to work in the nonprofit sector.

a Efird, our 2015 APPLES summer intern and a student at UNC Chapel Hill, Class of 2017, is a double major in Spanish and History, minoring in English. She currently resides in Chapel Hill, but is from Albemarle, NC. Her future plans include earning a Master’s of Social Work and a PhD in History to work in the nonprofit sector.

Leave a Reply